A Budget is a statement that gives the details of ‘where money comes from’ and ‘where the money goes to’.

In technical terms, the money that ‘comes in’ is referred to by terms such as income, revenue, receipts, etc., and the money that ‘goes out’ is referred to as expenses, expenditure, spending, etc.

A Budget has to have at least three details:

- It has to be for an entity, and for a defined purpose: an individual, an event, an organisation, a household, a business, a government, etc.

- It is for a defined time period: generally, a budget is drawn up for a year, but this can vary. For example - in the case of events or projects, budget can be for the duration of those events/projects.

- It gives details of receipts and expenditure: it lists all the sources from where money comes, and all the destinations where the money will go.

The following figures are a few examples of budgets:

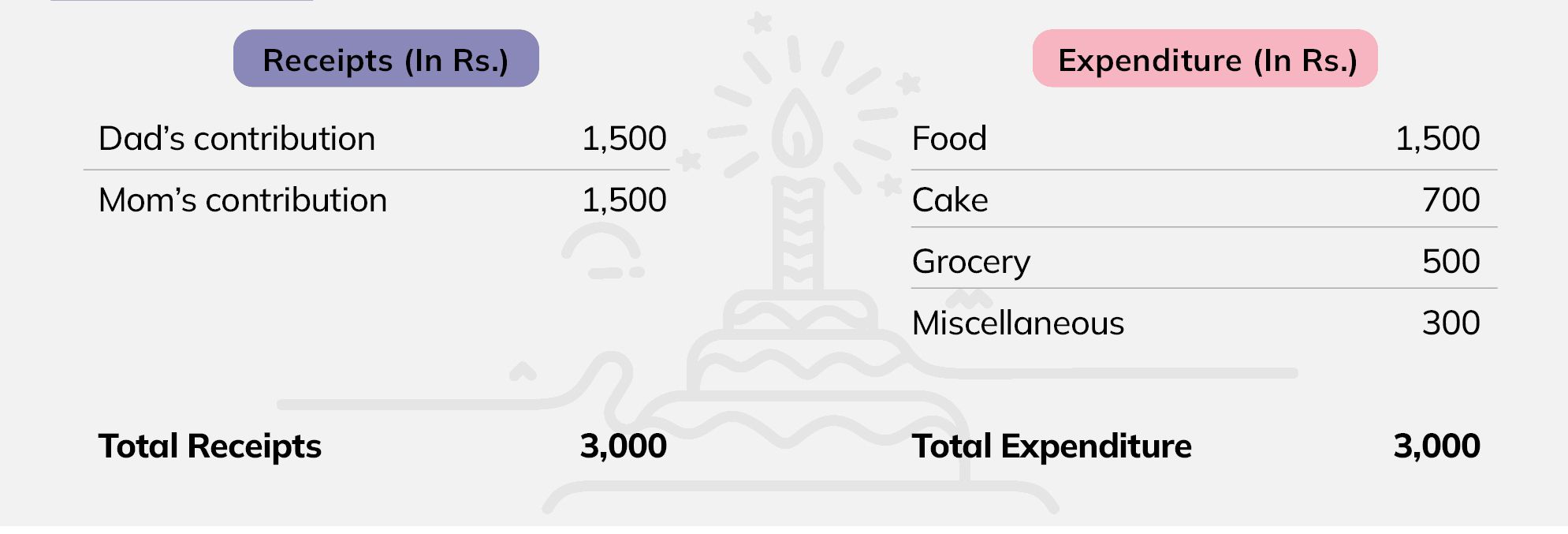

Figure 1: Budget for a Birthday Celebration

Figure 1 represents the simplest of budgets, for a birthday celebration. It also might be something many of us have prepared/experienced as well. The columns under receipt detail where the money came from and how much; the columns under expenditure detail where the money went, and how much was spent on each item.

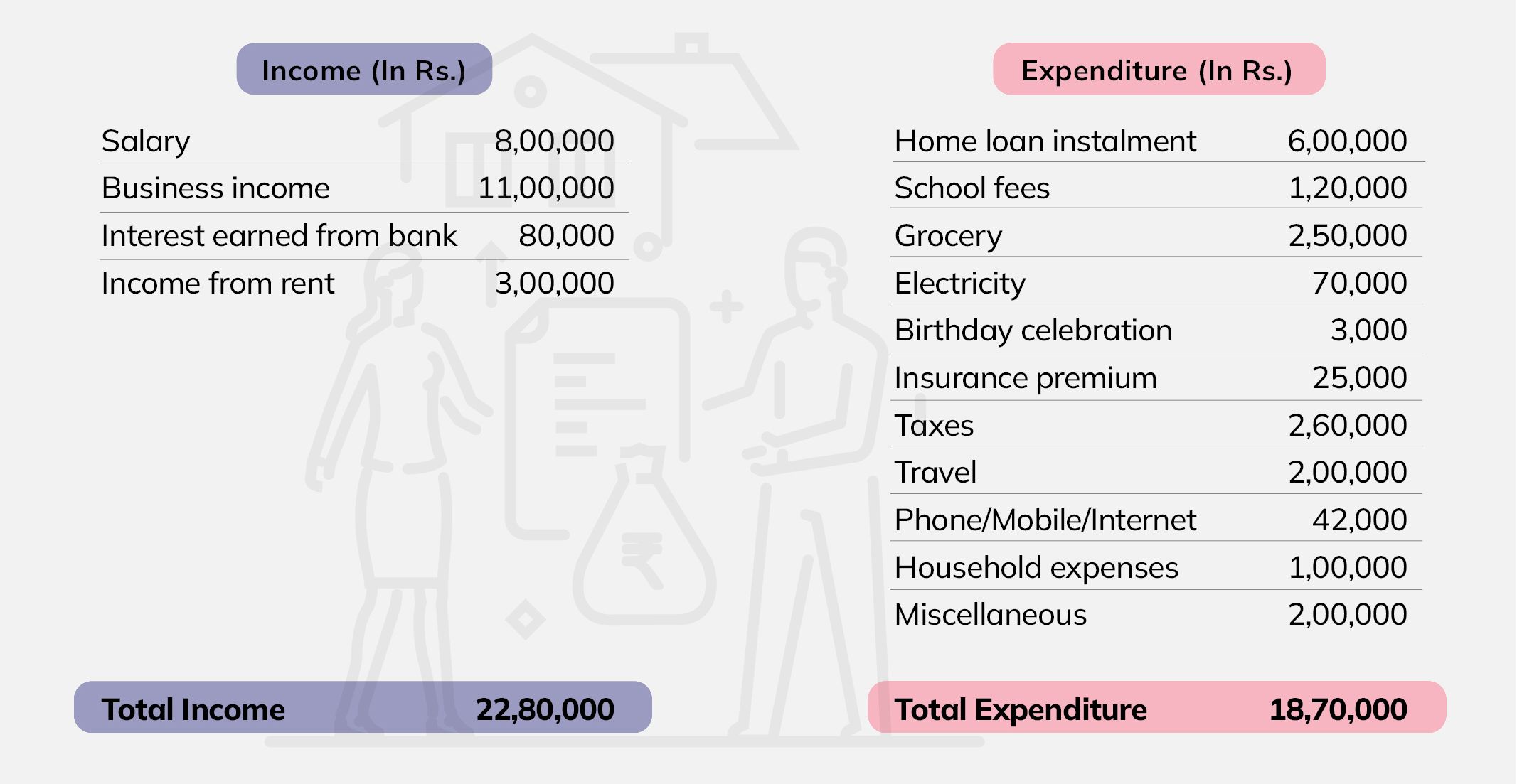

Figure 2: Annual Budget for a Household

Figure 2 provides a sample of annual budget for a household. In this particular year, this household expects to earn money from four sources, namely salary, business, interest on the money in a bank account, and rent from a house they own. The column under expenditure details the expenses the family expects to incur. The figures noted in second last row show the total of income and expenditure of the household. The last row shows that at the end of the year, the family expects to have a surplus of Rs 4,10,000. For families that have expenditure higher than income, this amount will be negative (a deficit), which means they have either used up their savings from the previous years, or they borrowed money that needs to be repaid.

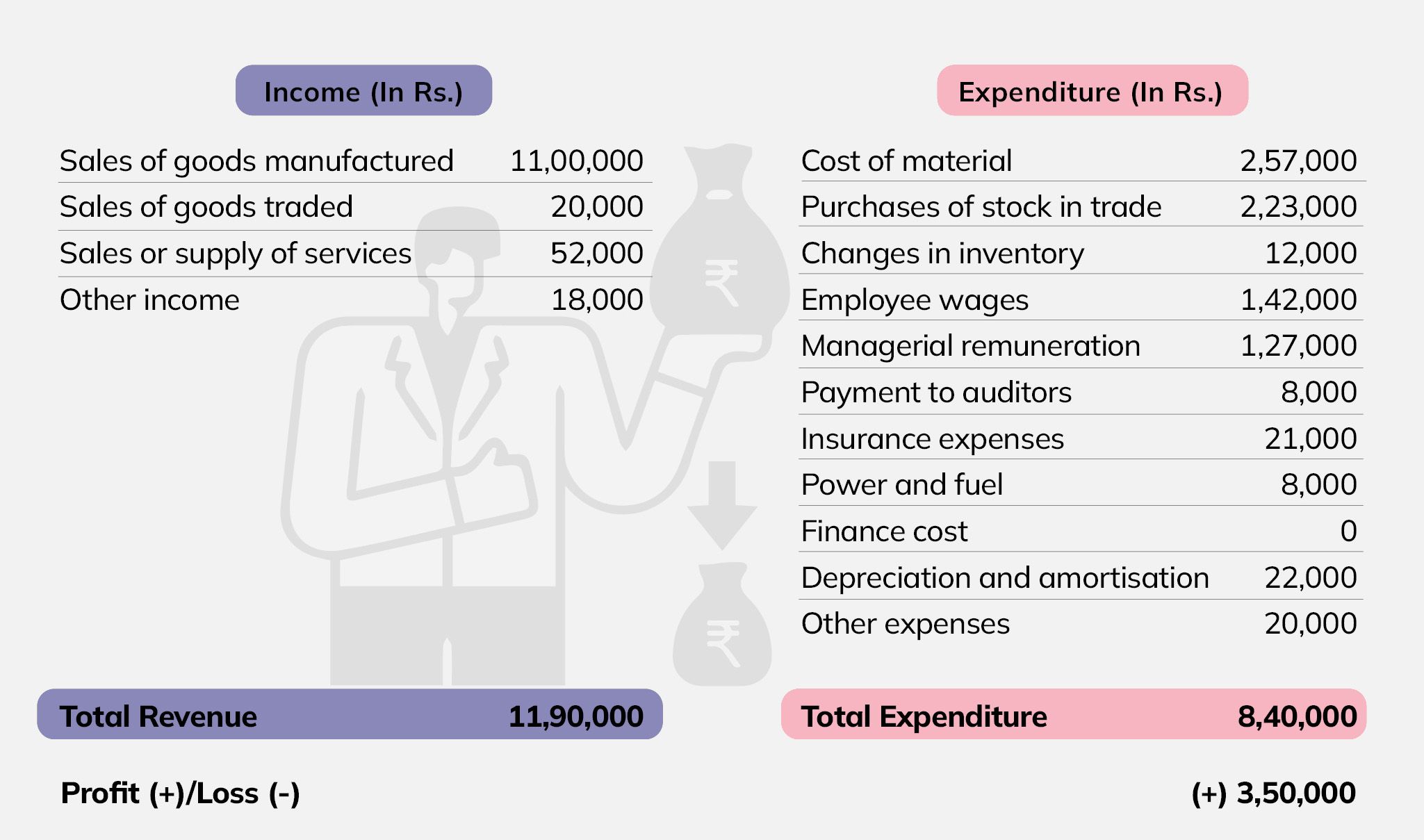

Figure 3: Annual Budget of a Business

Figure 3 presents a simplified sample of the annual budget of a company. In this year, the company expects to earn revenue from four sources, namely sale of manufactured goods, goods traded, supply of services and other income. The company’s anticipated costs are given under the column ‘expenditure’. The surplus of revenue over cost is the profit the company expects to make, which in this year is Rs 3,50,000.

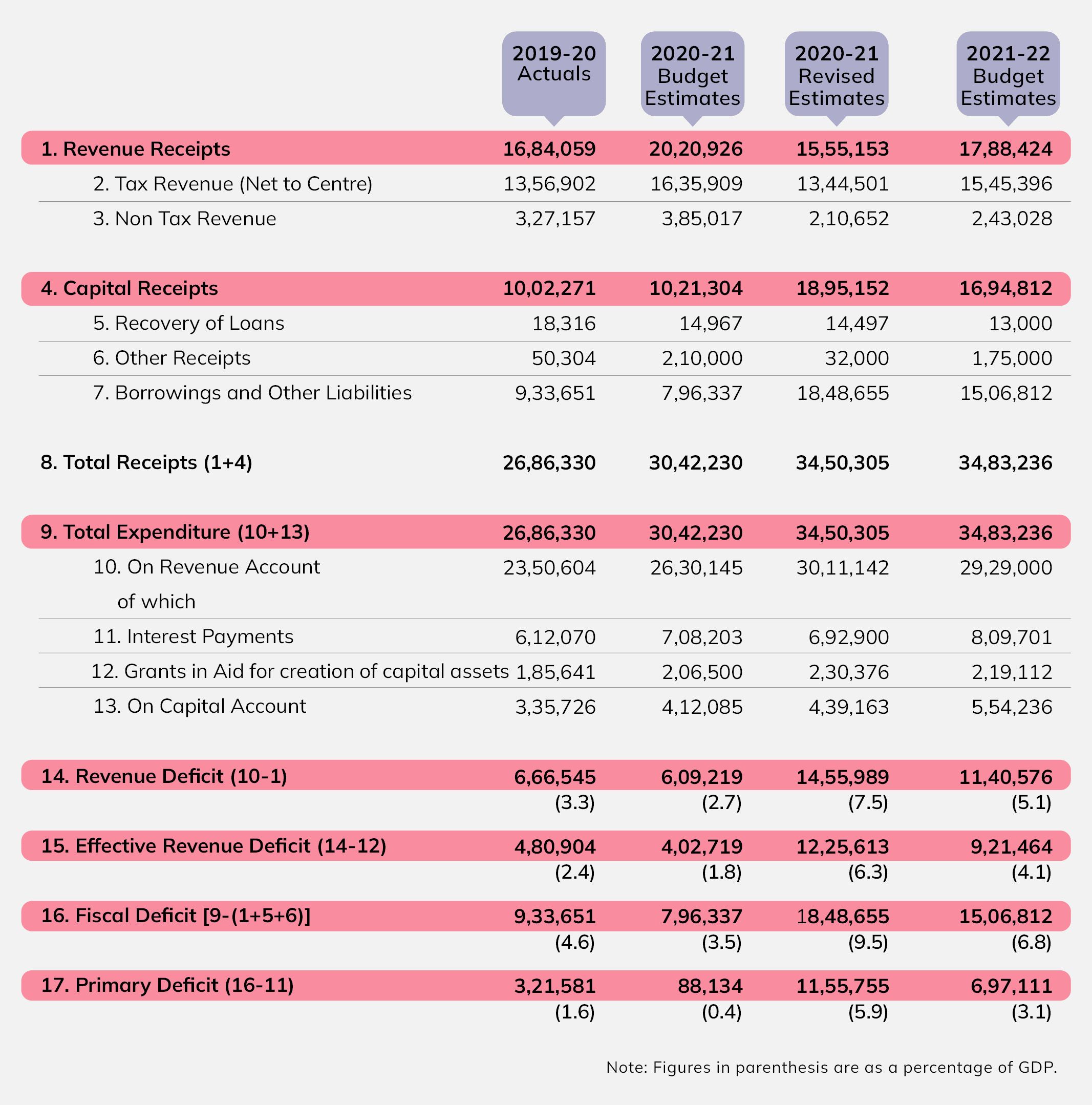

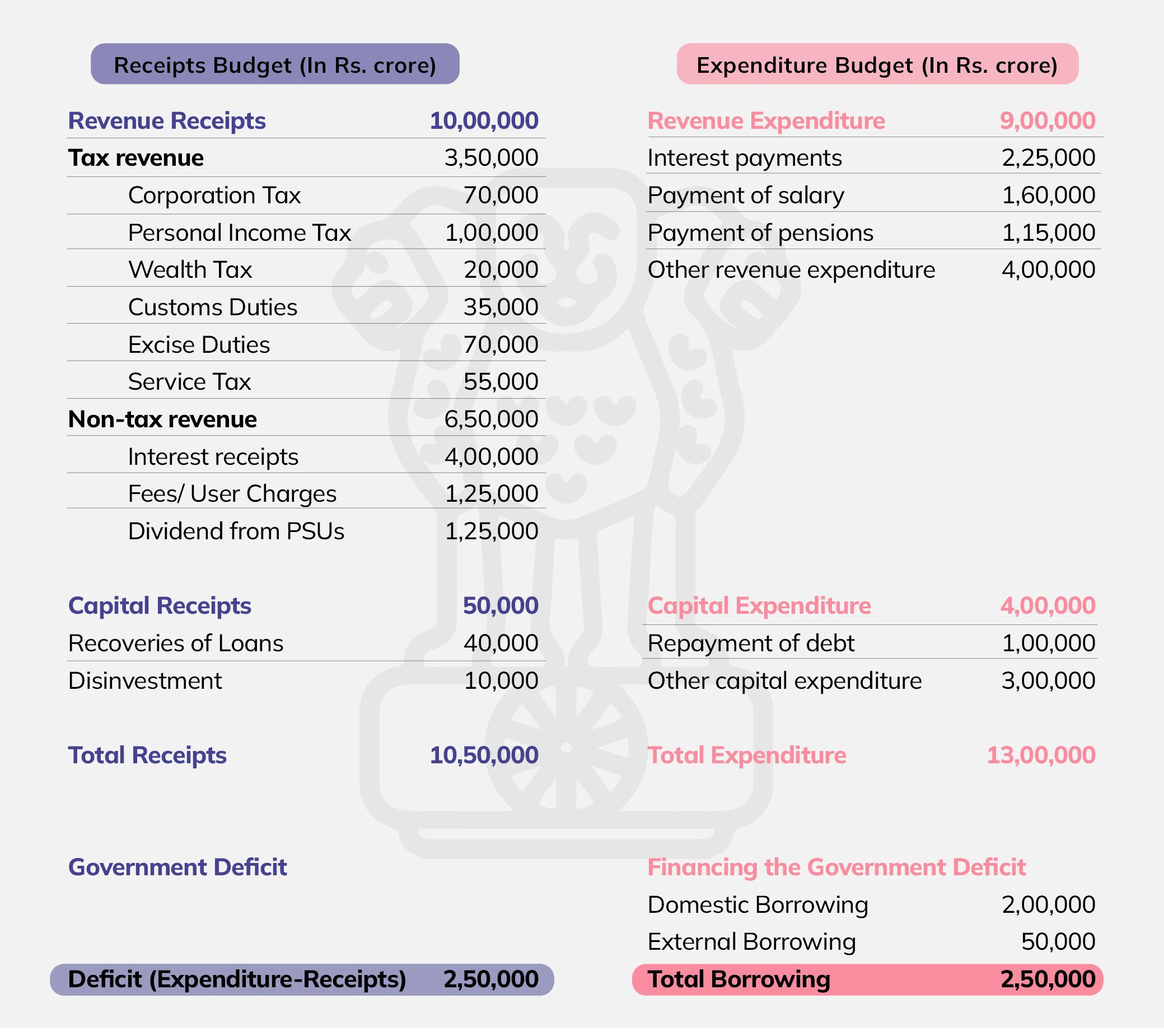

Figure 4: Annual Budget of a Government (In Rs crore)

Figure 4 shows a sample government budget. As can be seen, it is much more complex than the previous examples. The government receives money from sources including taxes, which only it can receive, and other entities such as households or businesses cannot. On the expenditure side, two broad categories are revenue expenditure and capital expenditure. Both of these have multiple components within them.

In this year, the expenditure is Rs 13,00,000 crore, while the receipt is Rs 10,50,000 crore. This results in a deficit of Rs 2,50,000 crore. The government finances this deficit by borrowing, partly from the domestic market, and partly through foreign borrowings. The government will need to repay this borrowed amount. One entry under expenditure, named ‘interest payment’, refers to the payment of interest on government borrowings in the past. Most government budgets are in deficit, but they can also have a surplus, i.e., the receipts can exceed the expenditure.

It should be noted that these are merely samples, and actual budgets are much more complex. This is especially the case for businesses and governments. Further details about government budgets are given in the following sections.