A well-functioning democracy requires that the governments are held accountable for their actions by the citizens of the country. Though, to hold them accountable requires information about various indicators including their performances. One such process of analysing and evaluating the performance of the government is called ‘Audit’.

What is Audit?

Audit can be defined as – A systematic inspection of the records related to a specific entity or event to verify if these follow the prescribed standards/guidelines.

For example, tasks undertaken by the government have specific objectives, are allotted a budget, and involve different process and actors. Once such process has been completed and the necessary data/information has been recorded, these records are inspected according to predefined standards and regulations to check whether:

- The budgetary allocation was spent as per the stated process,

- The actors/institutions adhered to the guidelines,

- There exist any discrepancies in the fund flow/expenditure, and so on.

A report is published consisting of all the findings of such inspection. All these procedures combined are termed as audit.

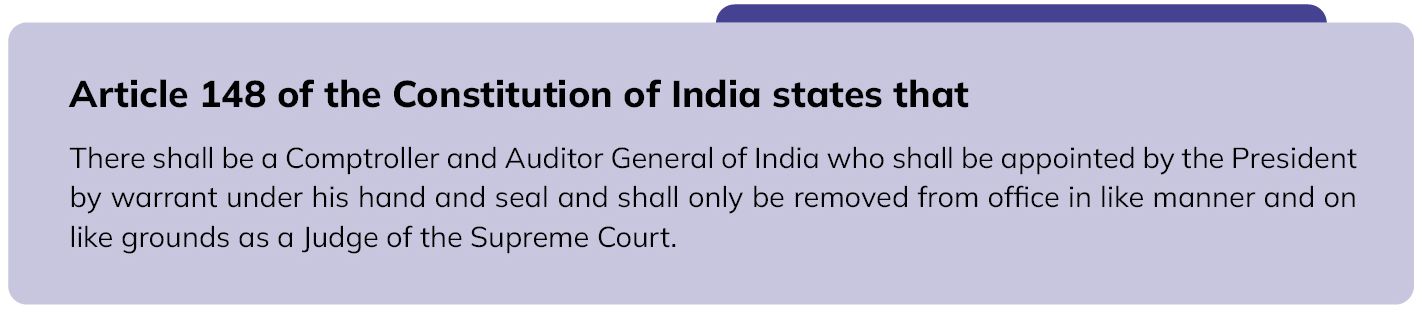

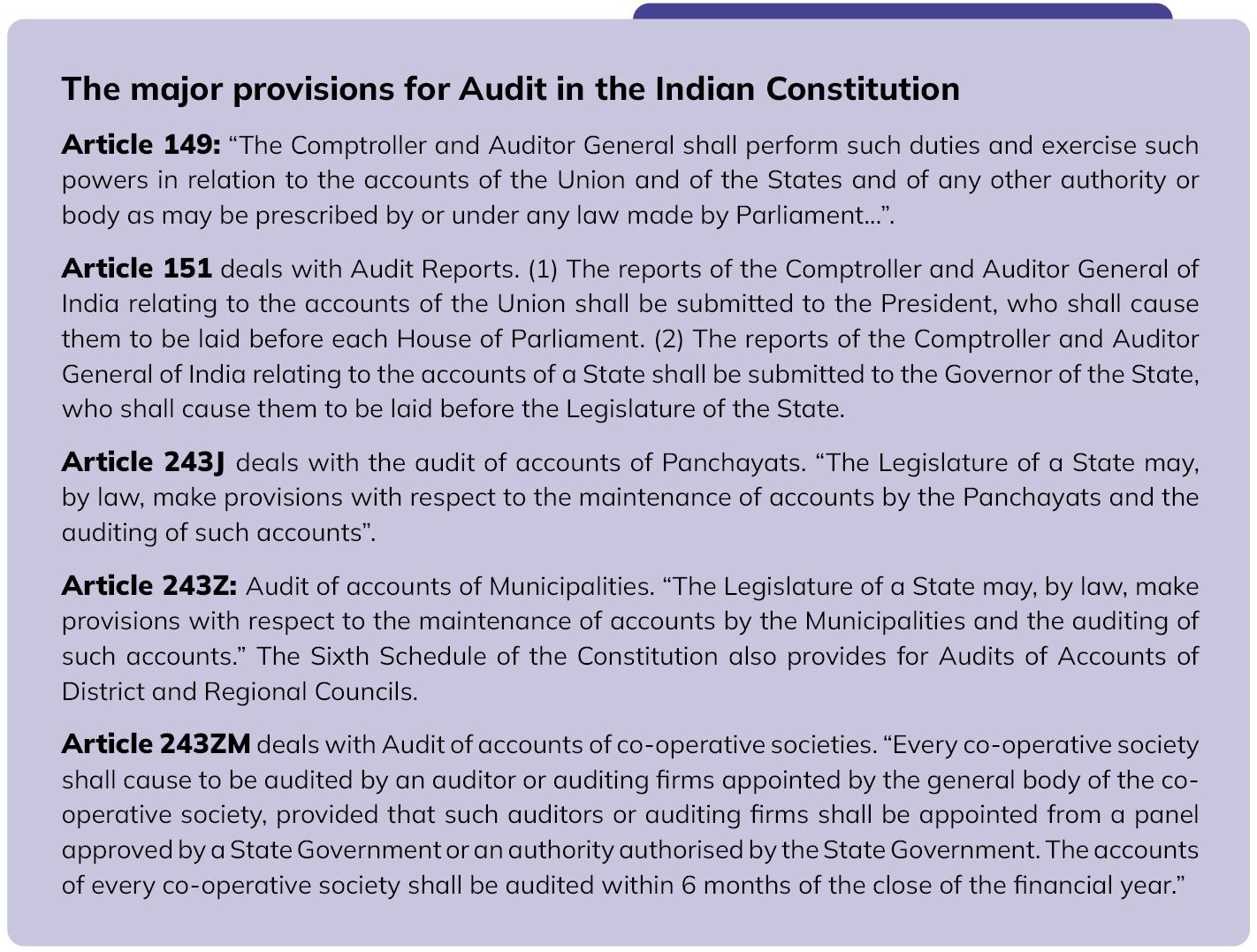

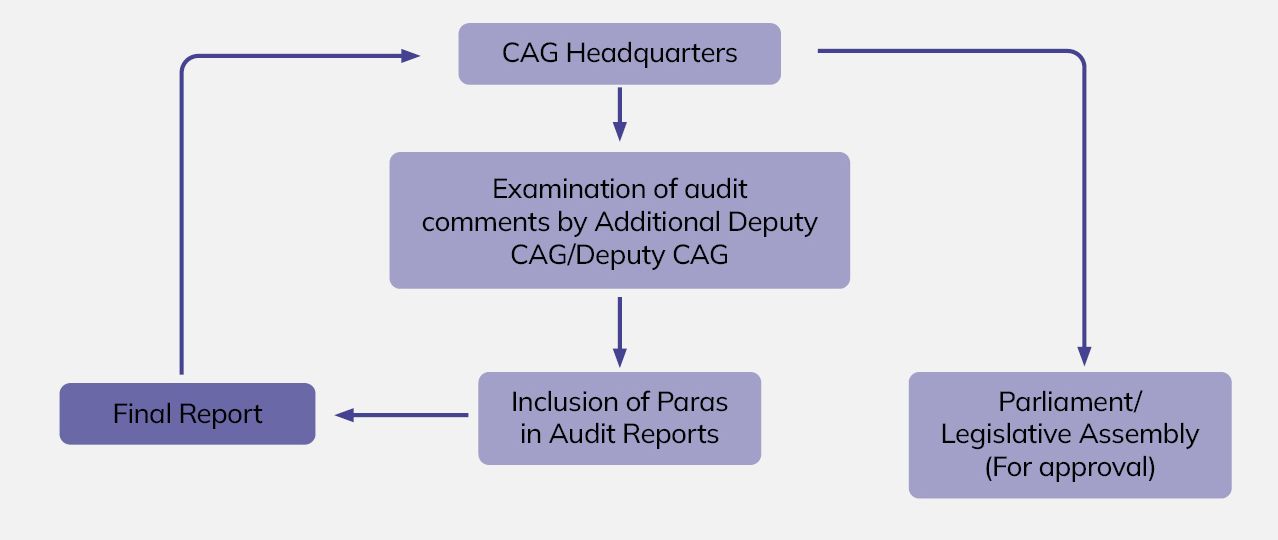

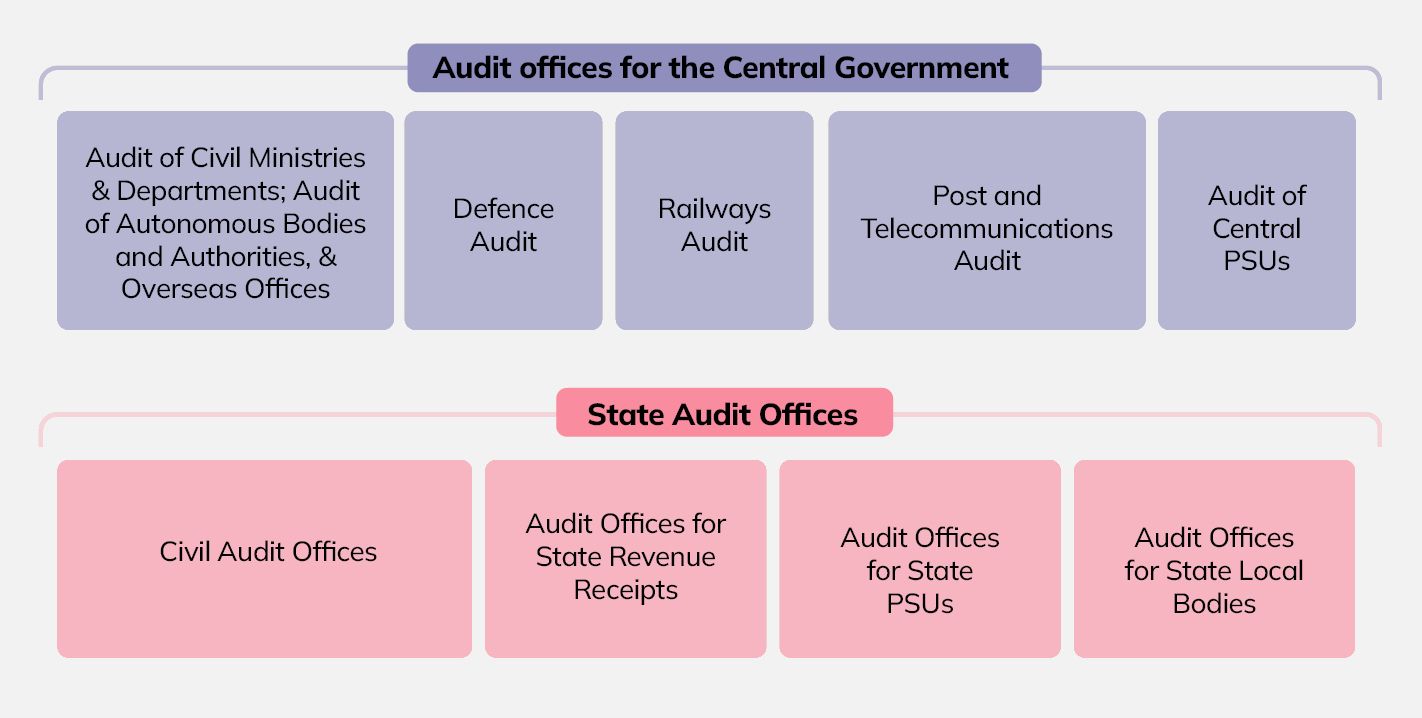

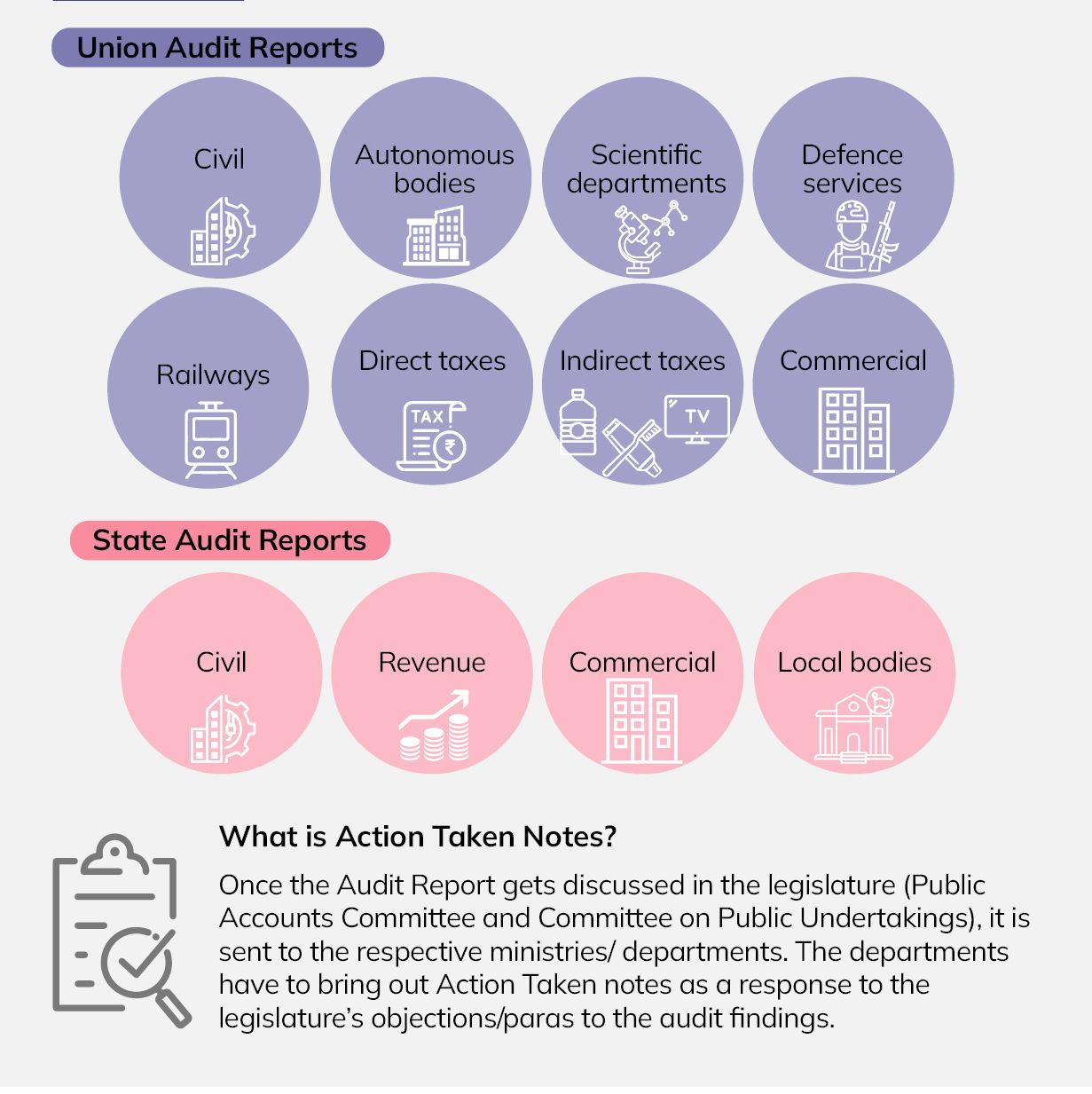

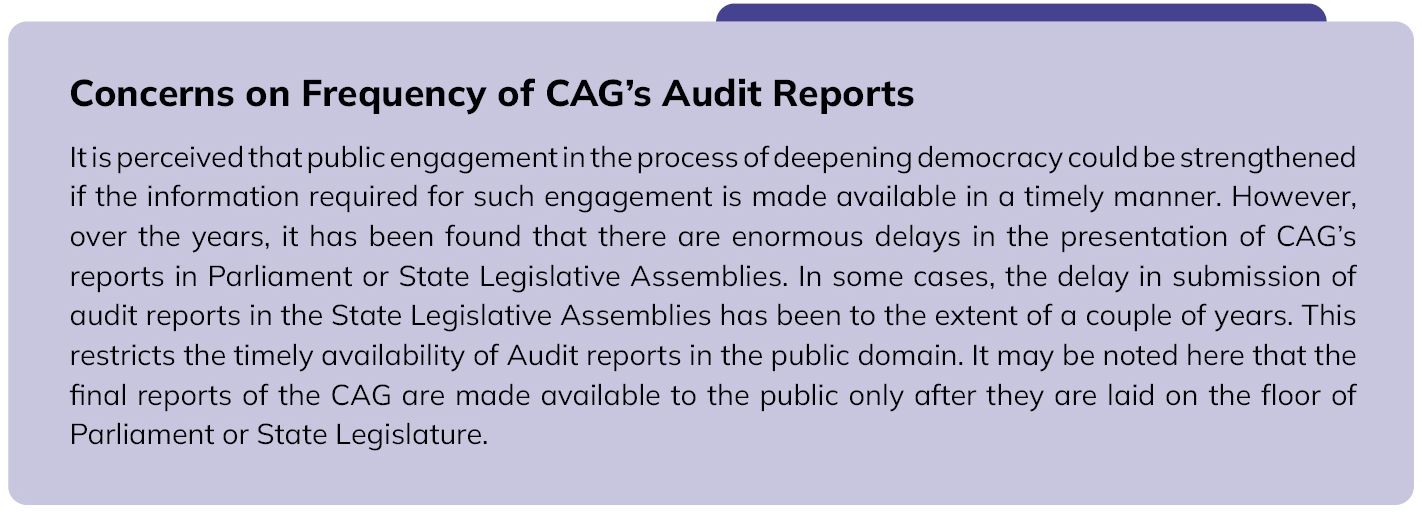

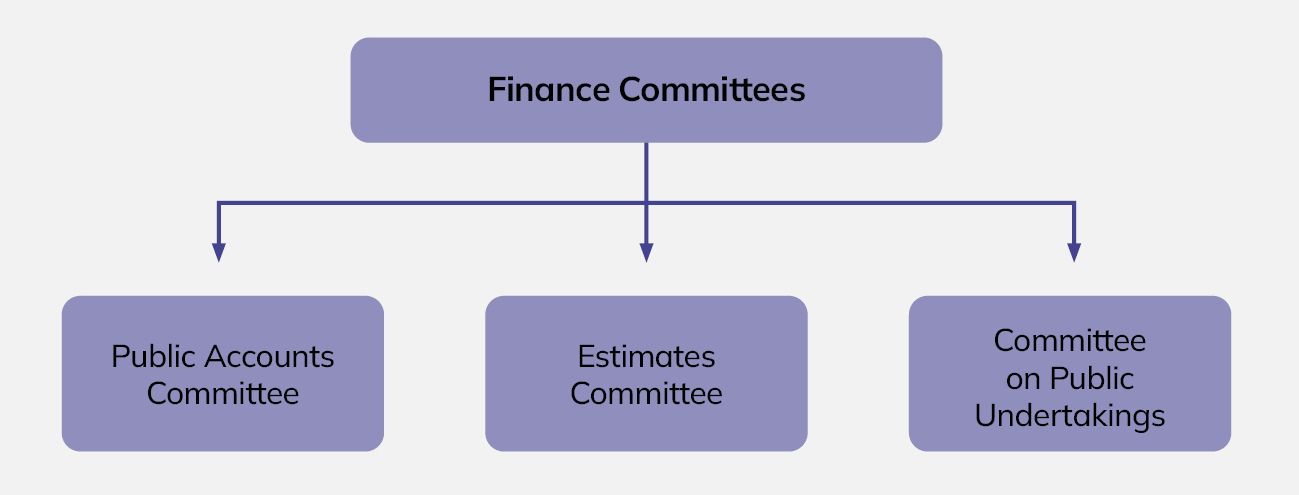

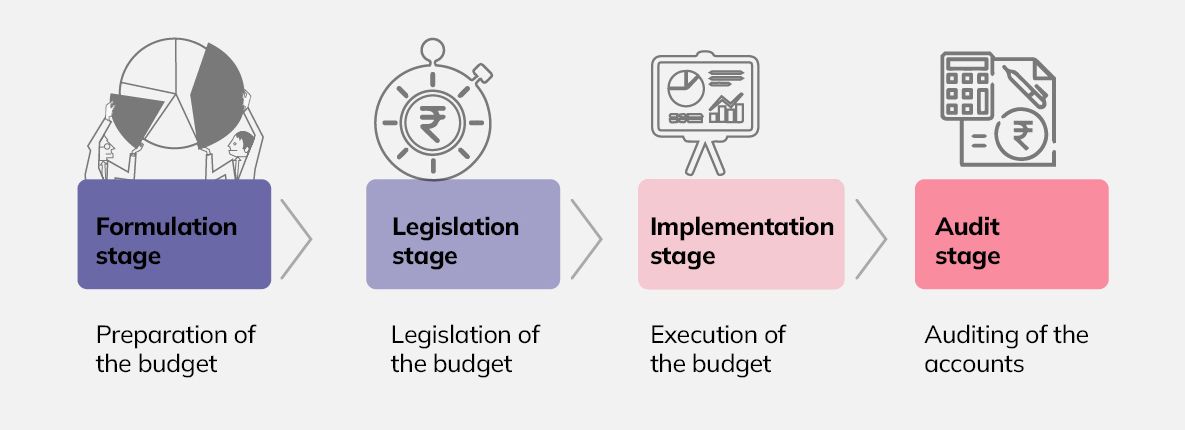

The budget sets out the fiscal policies of the government, detailing revenue, spending, and the economic policies on which these are based. As a public document, the budget requires public disclosure, evaluation, and auditing. The audit phase is the last stage in the budget cycle as it can be undertaken only once the necessary records and information are available. The audit reports are then presented to the President/Governors who then lay them before the Parliament or State Legislatures respectively before the budget season begins. Supreme audit institutions play a key role here. The auditor audits not only the expenditure but also the revenues. For instance, it checks whether correct procedures and rules have been followed while collecting taxes. Beyond this, it may also analyse the revenue implications of certain government policies.

It should be noted that in this section auditing has been discussed only in relation to government budget and performance. But, the process of audit has an extensive scope and is widely used across non-governmental and not-for profit organisations, businesses, corporations as well as educational institutions.

Figure 1 : Where does Audit fit in the Budget Cycle

Why Are Government Budgets Audited?

Audit, in essence, provides a tool to examine if government actions, such as budgetary allocations, scheme designs and implementation are in accordance with the applicable regulations and standards. It is expected to uncover financial discrepancies arising from use of public funds for personal gains, expenditure incurred in inefficient and/or ineffective ways, deficiencies in various processes, and any other case not in the best interest of the public at large. Hence, audit reports are instrumental in providing the public insights into the performance of the government that can enable them to demand greater accountability.

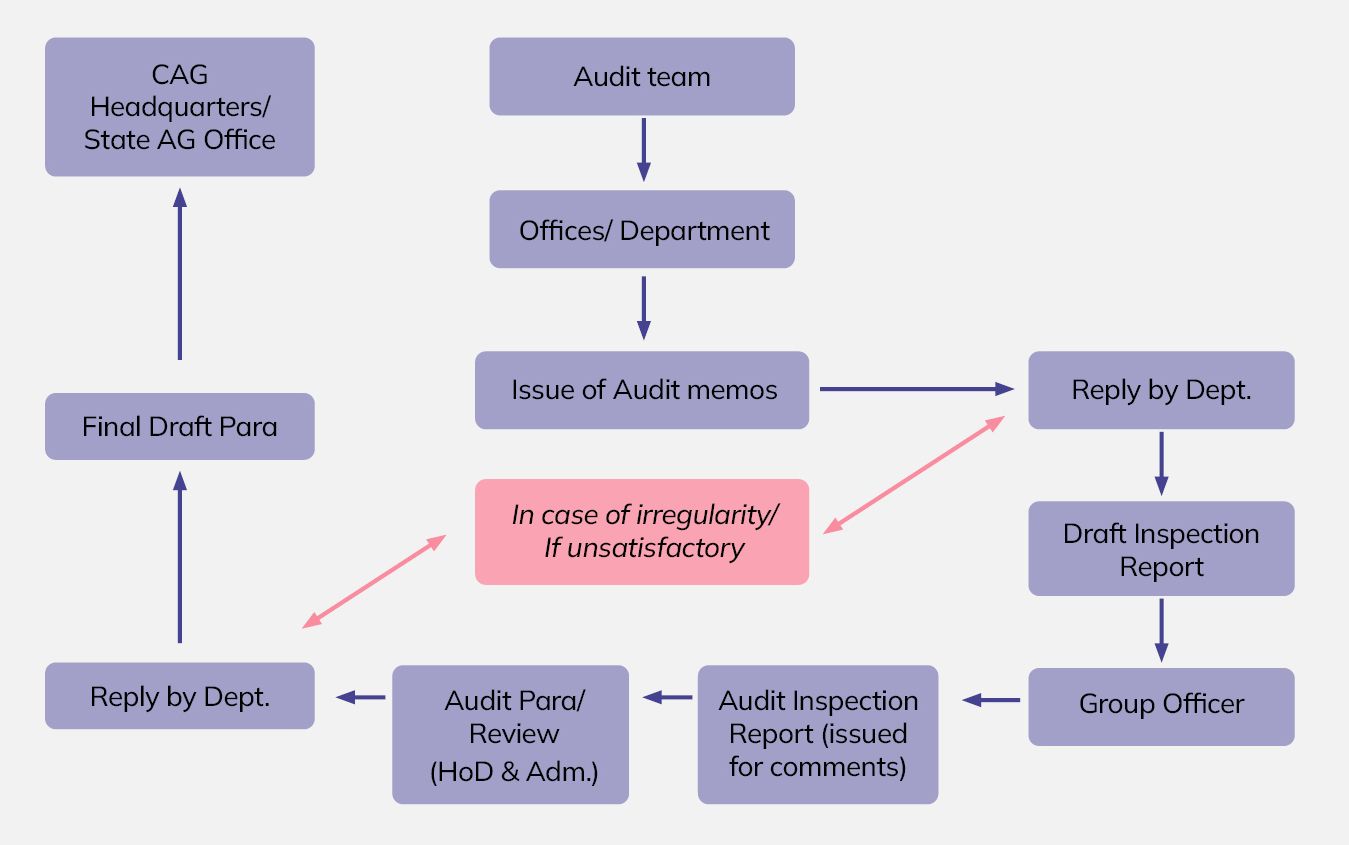

What is the Budget Audit Process?

The process of Audit generally involves an inspection of records and a subsequent publication of an audit report. The prerequisites for the same include the maintenance of all relevant records for the entity/event, and a predefined accounting standard. After the audit report is ready, it is sent to relevant stakeholders, such as ministries and parliamentarians. In most cases, it is also made public.

What are Different Types of Audits?

Based on the subject that is being audited, audits can be broadly classified into three streams, viz. Financial Audit, Regularity (Compliance) Audit, and Performance Audit. Each of these is discussed below.

Financial Audit

It is a process of scrutinising financial statements (records) to establish whether prescribed accounting standards for financial reporting and disclosures are complied with or not. Audit of Financial Statements involves inspecting whether these statements provide a reasonable assurance that the financial position, results of operations, and cash flows of an audited entity are presented in a true and fair manner, in accordance with prescribed accounting principles.

Compliance Audit

It is meant primarily to ascertain whether the expenditures reported by the government were as per the legislative authorisation through the Budget or not, and whether the expenditures incurred were in conformity with relevant laws, rules and regulations. It involves probing not only the legality of an action taken by a public official or a person using public funds, but also whether the decision or its implementation is according to the law, rules or regulations governing that activity.

Example: Compliance Audit

Along with government budgets, audits are also done on government funded institutes. One such audit is the Compliance audit. For instance, a compliance audit was done on Sardar Vallabh Bhai Patel National Institute of Technology (SVNIT), Surat. This audit found that SVNIT was not following the appropriate process which resulted in financial loss of revenue of Rs. 74.25 lakhs due to non-compliance of provisions of NIT Act & Statutes.

Here is an excerpt from the audit report:

As per Statute 38 of the First Statute of the National Institute of Technology (NIT) read with Section 26 of the NIT Act, 2007, ‘every NIT shall be a residential institution and all students and research scholars shall reside in the hostels and halls of residence built by NIT for the purpose’. In an instance of non-compliance of Statute 38 of the First Statute of the NIT, seat rent was not collected from all the enrolled students not residing in the Hostel, despite the request for the same being rejected by the 39th BoG. This resulted in loss of revenue to the tune of Rs.74.25 lakh for the period 2012-13 to 2018-19.’

Performance Audit

Performance Audit is an independent assessment of the performance of an organisation, programme, project or an activity in terms of its goals and objectives. It helps to know how far the expected results have been achieved from the use of available resources of money, personnel and material. It is undertaken to assess whether government programmes have achieved the desired objectives efficiently and effectively and at the lowest cost, and whether its benefits are reaching the intended beneficiaries. An evaluation of the economy, efficiency and effectiveness of public spending has come to be known as the 3E's audit.

Example: Performance Audit

A performance audit typically evaluates the implementation of the scheme as well as fund utilisation. The findings are compiled in a report which is then circulated to the department concerned. A performance audit report brings out the major systemic flaws in the scheme and also presents recommendations to address them. There is no fixed rule that a performance audit has to be conducted for all schemes. Usually, the Comptroller & Auditor General (CAG), of India which is the supreme audit institution in India, decides which schemes need to be audited. In some instances, the departments send out a request for a performance audit to be conducted. In deciding the performance audit, the auditor can devise a range of indicators depending upon the nature of schemes. An illustrative list of indicators to measure the effectiveness of Mid-Day Meal Scheme is as follows.

- Regular provision of mid-day meals

- Lifting of food grains (adequacy)

- Quality of food grains and edible oils in terms of nutrition

- Extent of budget provision/ utilisation

- Utilisation of Central funds for building kitchen sheds/schools without kitchen sheds

- Coverage of Schools/Education Guarantee Scheme (EGS)/Alternative & Innovative Education (AIE) centres

- Availability of drinking water facilities in schools

- Measuring impact on health

- Monitoring and supervision

These are a few indicators; CAG audit report makes a detailed analysis on various such qualitative aspects.